Adyen, the Dutch payment processing powerhouse, started with a simple yet ambitious goal: to revolutionize the fragmented payments industry.

The Beginning: Solving Payment Complexity

In 2006, a group of Dutch entrepreneurs, led by Pieter van der Does and Arnout Schuijff, saw a major problem in online payments. Most businesses had to work with multiple outdated payment providers, each with different fees, processes, and inefficiencies. They envisioned a single modern, scalable payment platform that could handle transactions globally without requiring businesses to juggle multiple vendors.

With that vision, they founded Adyen—which means “start over” in Surinamese—to signal their fresh approach to payments.

Building a One-Stop Payment Solution

Unlike existing solutions, Adyen built a unified payments platform from scratch. Instead of relying on third-party banking systems, they created their own infrastructure to process credit card payments, local payment methods, and mobile transactions in multiple currencies.

Their strategy was simple but effective:

- One platform for all payments—online, in-store, and mobile.

- Global reach—businesses could accept payments in different currencies and regions seamlessly.

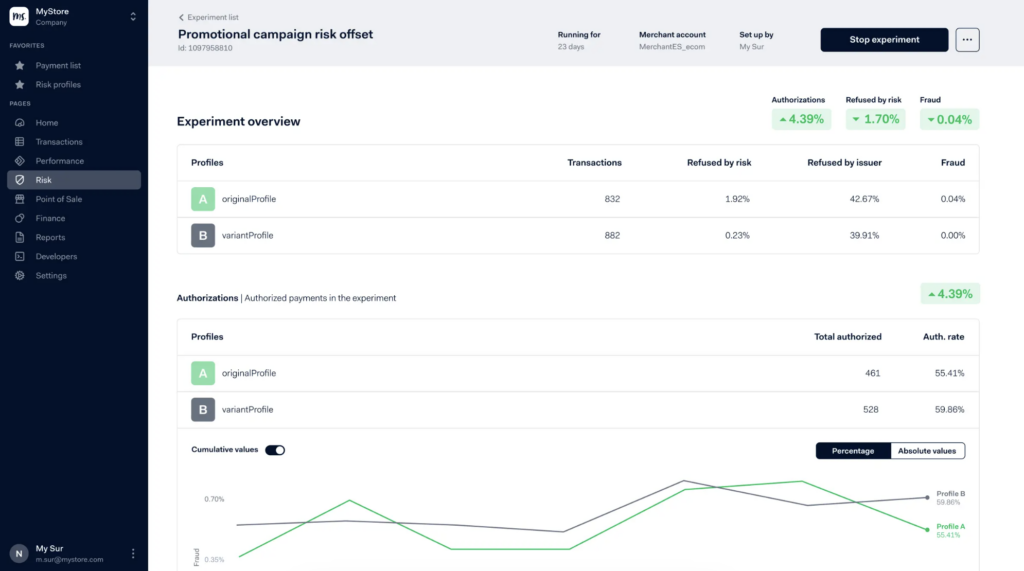

- Data-driven insights—allowing businesses to optimize payments and reduce fraud.

Early Success and Big Clients

Adyen’s breakthrough came when Groupon became one of its first major clients. Soon, other global companies like Facebook, Uber, Spotify, and Netflix started using Adyen’s platform, drawn to its seamless integration and ability to scale worldwide.

As e-commerce and digital payments grew, so did Adyen. By 2015, it was handling billions of euros in transactions annually.

IPO and Market Domination

In 2018, Adyen went public on the Euronext Amsterdam stock exchange, instantly becoming one of Europe’s most valuable fintech companies. Investors saw its potential as a disruptor in a market dominated by traditional banks and legacy payment processors like PayPal and Worldpay.

Where Adyen Stands Today

Today, Adyen processes payments for some of the biggest companies in the world, supporting over 200 payment methods across 100+ countries. With its direct banking relationships, advanced fraud prevention tools, and innovative technology, it continues to lead the payments industry.

What started as a bold idea in the Netherlands is now a global fintech powerhouse, handling trillions of euros in transactions and shaping the future of payments.