In an era where digital transactions are ubiquitous, ensuring secure and efficient identity verification has become paramount. Fourthline, established in 2017 and headquartered in Amsterdam, Netherlands, has emerged as a leading provider of Know Your Customer (KYC) and Anti-Money Laundering (AML) solutions, catering primarily to the financial sector.

Origins and Evolution

Initially known as Safened, Fourthline was founded by Pieter van der Does and Arnout Schuijff. The company underwent a rebranding in 2019 to better reflect its expanded focus on comprehensive digital identity verification services.

Comprehensive Service Offerings

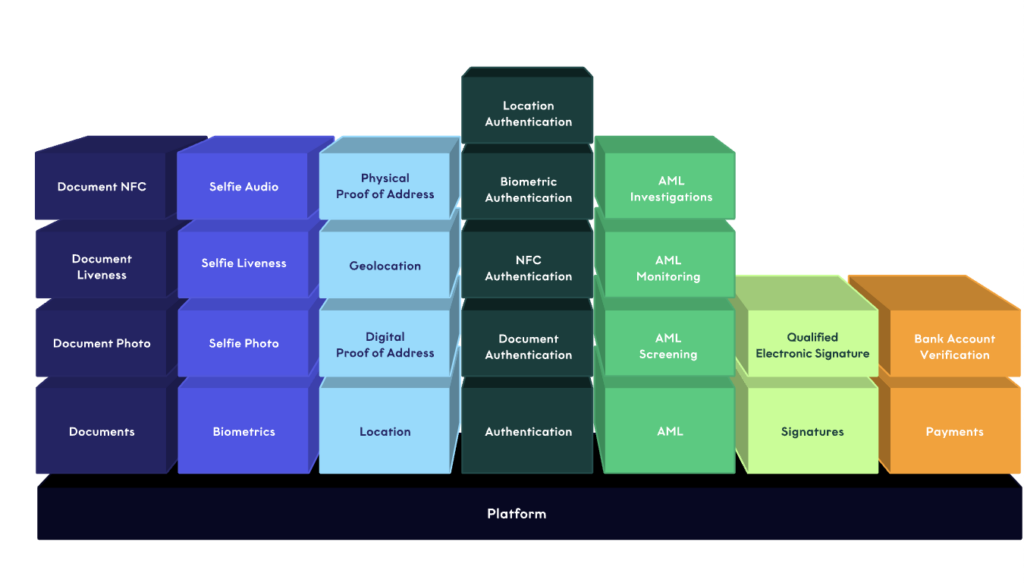

Fourthline’s platform addresses critical identity challenges through a modular approach, allowing seamless integration tailored to specific client needs. Key services include:

- Identity Verification: Utilizing advanced AI-driven photometric algorithms, Fourthline ensures accurate biometric verification, enhancing the reliability of customer identification processes.

- AML Screening & Monitoring: The platform conducts thorough checks against global watchlists and monitors transactions to detect and prevent illicit activities.

- Digital Proof of Address: Simplifying the process of address verification, this feature enhances user experience while maintaining compliance standards.

- Client Authentication: Providing secure authentication mechanisms to protect against unauthorized access and fraud.

Strategic Partnerships and Collaborations

Fourthline has established significant partnerships to enhance its service delivery:

- Rabobank Integration: In June 2024, Fourthline integrated its digital identity verification solutions into Rabobank’s identity services platform, strengthening the bank’s compliance and security measures.

- Collaboration with Qonto: In December 2023, French business banking fintech Qonto selected Fourthline’s onboarding technology to streamline and fortify its customer onboarding processes across France, Spain, and Italy.

- Partnership with Hawk AI: Fourthline partnered with Hawk AI to integrate comprehensive digital onboarding and business KYC solutions with advanced transaction monitoring capabilities, offering clients a unified AML program.

Financial Milestones

In April 2023, Fourthline secured $54 million in a Series C funding round, led by investors including Finch Capital. This investment underscores confidence in Fourthline’s mission to enhance ID verification and compliance tools within the financial sector.

Industry Recognition and Impact

Fourthline’s innovative solutions have positioned it as a key player in the regtech landscape. The company’s commitment to addressing the complexities of digital identity verification and compliance has earned it recognition among top competitors, such as IDnow and Socure.

Conclusion

As digital interactions continue to proliferate, Fourthline stands at the forefront, providing robust and adaptable solutions to meet the evolving demands of identity verification and compliance. Its dedication to innovation and strategic collaborations ensures that it remains a trusted partner for financial institutions navigating the complexities of the digital age.